In March 2022, Nomura Asset Management (“NAM”) announced the launch of Project BRIDGE.

The project leverages NAM’s network to promote the appeal of Japanese equities to investors around the global through the medium of NAM’s Japan equity strategies. Alongside this, the Engagement Department, which was established in November 2021, will be leading efforts to deepen our understanding of portfolio company business strategies and the environments they occupy, while working to improve their corporate value through constructive dialogue.

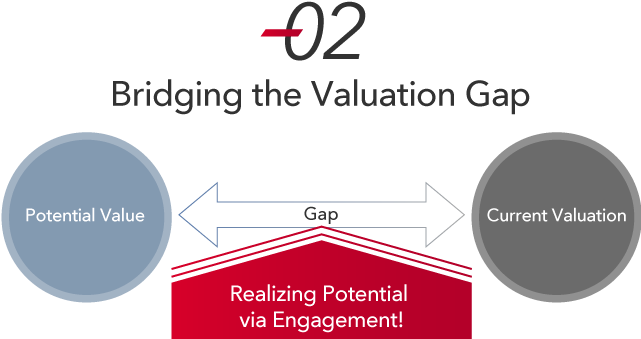

Through our engagement activities, NAM will seek to bridge the gap between the market valuations of Japanese companies and their true potential. In doing so, we hope to connect global investors and Japanese companies and enhance Japan’s role and presence as an international capital market.

Japanese companies have the technological expertise and growth potential to compete with their peers globally. However, their true value is not reflected in current market valuations.

Through our engagement activities, NAM will seek to bridge the gap between the true potential of Japanese companies and their market valuations.

READ MORE *

*You will leave the website of Nomura Asset Management U.S.A. Inc. and will switch to the website of NOMURA ASSET MANAGEMENT CO., LTD

READ MORE *

*You will leave the website of Nomura Asset Management U.S.A. Inc. and will switch to the website of NOMURA ASSET MANAGEMENT CO., LTD

Engagement (Dialogue with Companies)

A deep understanding of investee companies and their business environment is the starting point of constructive dialogue. Through these activities, NAM seeks to improve both the social value and economic value of the companies within our portfolios.

*You will leave the website of Nomura Asset Management U.S.A. Inc. and will switch to the website of NOMURA ASSET MANAGEMENT CO., LTD

In order to realize a virtuous cycle of investment (investment chain), asset managers must connect the companies within their portfolios with final beneficiaries, and encourage corporate reform that contributes to a more prosperous society. An important tool in achieving this is engagement.

For an asset manager like NAM, engagement with a company is absolutely necessary to understand its management and its potential to create value over the medium- to long-term. I believe that obtaining such a deep understanding is the first step in fulfilling our stewardship responsibilities.

As Japan’s representative asset manager, Nomura Asset Management will continue deepening its understanding of the business environments of our portfolio companies, enriching our engagement activities to contribute to sustainable growth, and working to realize sustainable economic growth alongside a more prosperous society.

Yuichi Murao

Senior Corporate Managing Director

Chief Investment Officer